Invoice finance provides working capital cash flow facilities for businesses far in excess of what would usually be made available by a bank overdraft. Even if all of your customers pay on the due date, you are still missing vital cash flow that invoice finance will enable you to unlock. What is your current debtor balance? With an invoice finance facility you would be able to borrow up to 90% of this balance today.

Invoice Finance is gaining in popularity and up to 10% of all invoices throughout the world are funded by invoice finance as it is such an effective way to get cash flow into the business.

We have a variety of invoice finance products available so regardless of whether you want to fund the occasional invoice or have an ongoing overdraft we will be able to assist you.

As your debtors are our security we do not usually require collateral assets such as property to be able to lend.

The process is easy and you will be impressed at the freedom that unlocking the cash in your debtors will allow.

Our Loan Calculator is provided as an indicator of affordability only. It is not an exact calculation of what your finance will cost. Please contact us to determine your specific needs and we will provide an accurate quote for your finance requirements.

Apply Here:

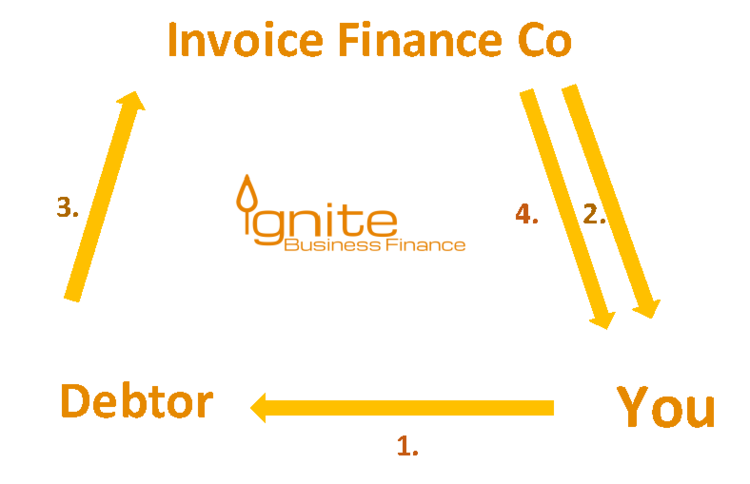

- Invoice your Customer

- Invoice Finance company pays 90%

- Customer pays Invoice Finance company

- You receive the remaining 10% (less fees)

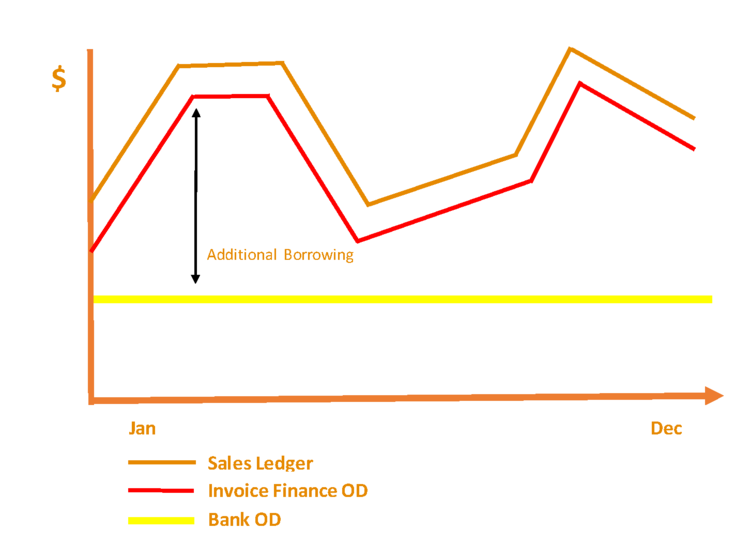

Bank Overdrafts are inflexible. They are fixed at a point in time. Invoice finance facilities move with your fluctuating turnover without review. An invoice finance facility (which can be used alongside a bank OD) will see your business through its seasonal peaks and grow as the business does.

As the name suggests Single Invoice Finance enables you to select individual invoices at your sole discretion to be funded on. There are no ongoing commitment or obligation to fund invoices aside from the specific ones that you need to be paid immediately.

This is ideal for Clients that have the occasional large invoice that they will need funded while having enough working capital for their day to day activities.

It is a ‘come and go’ facility often used as a back up just in case the Client ever needs it.

Invoice factoring (or Invoice Finance) provides an ongoing cash flow overdraft of up to 90% of the value of your debtors ledger. Each week or as appropriate provide a of invoices as you produce them and be paid immediately.

Invoice finance gives you immediate access to your invoices turning your business into a cash business.

Invoice finance facilities can be used instead of or in addition to existing overdraft facilities and give your business the cash flow boost it needs.

Undisclosed Invoice Finance, for those who qualify, provides all of the cash flow benefits of an invoice finance facility without notifying your customers of the relationship.

Each week up to 90% of the value of invoices created is made available to use on call like an overdraft.

We access your accounting systems and provide you with this seamless cash flow overdraft.

How long do I need to have traded to qualify for invoice finance?

In most cases we will be happy to fund start ups using invoice finance. Our security is in the debtor that we are funding so trading history as not as important as for other products.

Do I qualify for invoice finance?

If you are dealing with other businesses on credit terms and invoicing for completed work or services you will likely qualify for invoice finance

Do my debtors need to know?

In most cases your debtors will need to be made aware of the invoice finance relationship. This is not generally a bad thing as most companies are already dealing with invoice finance companies as it gains in popularity.

Some Clients may, however, qualify for our undisclosed invoice finance product. This product is entirely undisclosed to your customers.

With undisclosed invoice finance we connect to your accounting system and load the total balances you create on a weekly basis. You are allocated a new anonymous bank account for your customers to pay into.

To qualify for invoice finance you need to be profitable with a good spread of debtors.

Call us on 0800 646 453 if you have any further questions

Purchase Order Finance

Are you receiving large orders you would like to fund? Enquire about Purchase Order Finance.